From declining timber quality to carbon exposure, forest degradation is harming market resiliency. We provide visibility to this issue to empower your decisions.

Forest Degradation, Seen

Forest degradation is reshaping market resiliency, but few are monitoring the issue. We’ve brought together leading research, investor strategies, and corporate disclosures summary to highlight forest degradation, so you can better navigate evolving risks and opportunities tied to natural resources.

What is Forest Degradation?

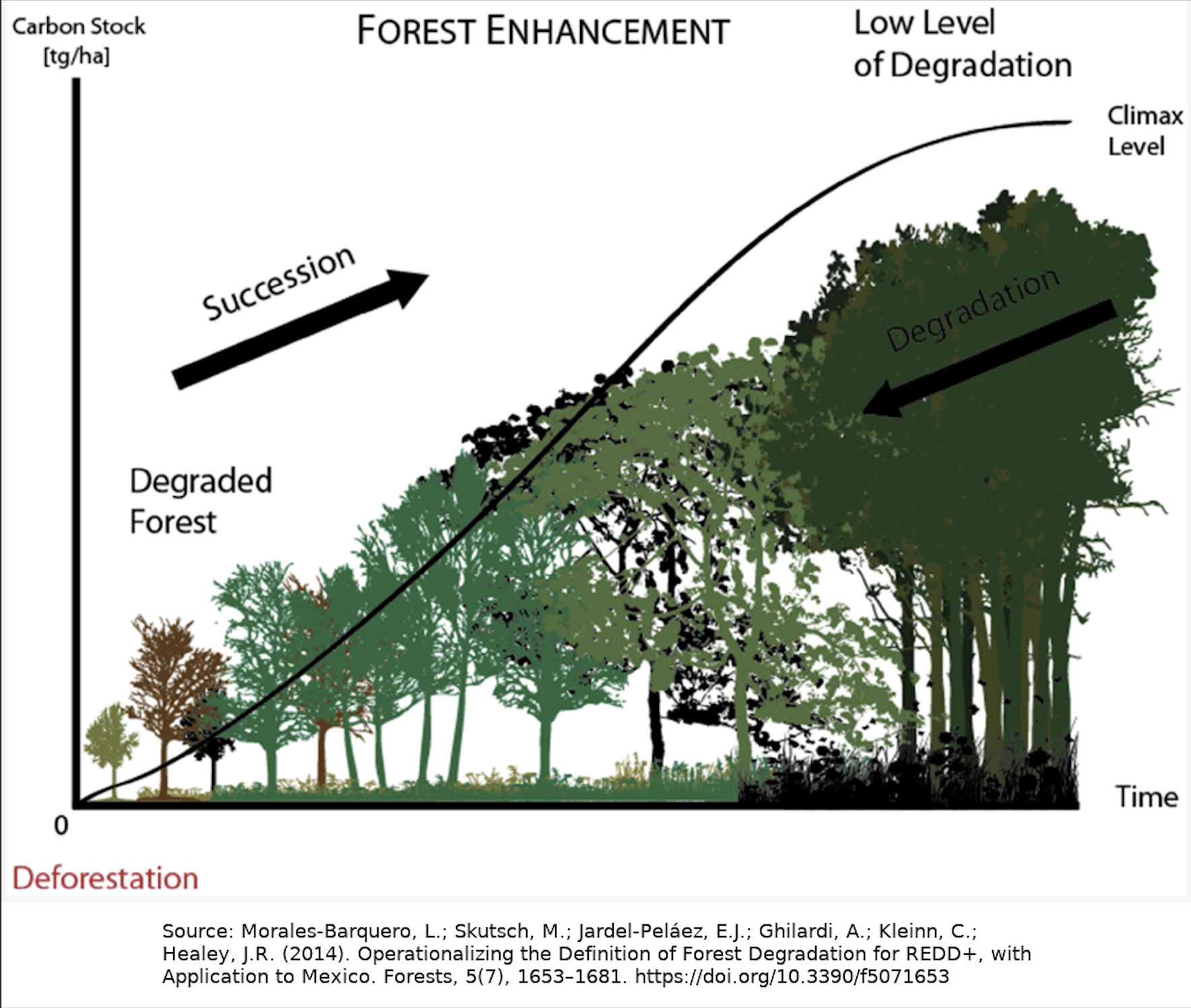

Forests don’t need to fall to be lost. Forest degradation occurs when a forest remains standing but loses its ecological health, biodiversity, and ability to store carbon. It’s the quiet erosion of life — from selective logging and road building to recurring fires — that weakens ecosystems long before a single tree is cleared.

Unlike deforestation, which wipes forests off the map, degradation can seem subtle. Its effects, however, are just as devastating. According to the Forest Declaration Assessment 2025, degraded forests now span an area larger than Austria every year — releasing vast amounts of carbon and unraveling the natural resilience that forests once provided.

These forests may still be counted as “intact” on paper, but their function is collapsing: they store less carbon, support fewer species, and offer diminishing economic and cultural value. Recognizing this is crucial — a degraded forest can experience the same ecological and financial losses as deforested land, and addressing degradation is every bit as urgent as stopping deforestation itself.

Why Degradation Matters

01

Supply Chain Disruption

Degraded forests undermine the reliability of commodity supplies by reducing yields, lowering timber quality, and disrupting ecosystem services such as water regulation and soil fertility. For companies dependent on pulp, paper, food, and agricultural commodities, this translates into unstable sourcing and cost volatility. Investors holding these firms face heightened exposure to shocks across global supply chains, especially as climate change amplifies the impacts of degradation.

02

Regulatory Compliance

Governments are increasingly introducing regulations focused on forest risk — not only on deforestation but increasingly on degradation — such as the EU Deforestation Regulation (EUDR), which requires companies to prove that goods are not linked to deforestation or forest degradation. Companies that fail to demonstrate sufficient traceability and sustainable sourcing may face rising costs of compliance, trade restrictions, or reputational harms, all of which can affect the value of investment portfolios.

03

Operational Risk

Businesses reliant on healthy forests for raw materials, ecosystem services, or physical infrastructure stability face operational disruptions when degradation weakens these systems. Collapsed watersheds, soil erosion, and biodiversity loss can halt production, increase input costs, and trigger community or regulatory opposition. These risks are especially acute in sectors like forestry, agriculture, mining, and infrastructure that operate directly within forested landscapes.

04

Stranded Assets

Forest degradation can render once-valuable assets obsolete. Processing facilities, transportation networks, or plantations designed around healthy forest ecosystems may lose viability when inputs become unreliable or ecological thresholds are crossed. As degradation accelerates, the risk of stranded assets grows, leaving investors holding infrastructure and capital investments that no longer generate returns.

05

Insurance Cost

As forest degradation drives higher wildfire risk, flooding, and other ecological instabilities, insurance premiums rise. In regions where degradation interacts with climate change, insurers may withdraw coverage altogether, leaving companies exposed to unmanaged physical risks. For investors, this means increased operating costs, higher risk-adjusted capital requirements, and in some cases, loss of insurability across critical geographies.

06

Commodity Volatility

Degraded forests contribute to unpredictable swings in commodity markets, particularly in agriculture and timber. Reduced yields, increased pest outbreaks, and climatic instability lead to volatile pricing, which cascades through supply chains and affects market valuations. For investors, this volatility creates uncertainty in forecasting, portfolio stability, and long-term returns.

Assessment Tools

See the science behind forest risks — Understanding the critical relationship between forest degradation and deforestation is fundamental to accurate risk assessment and investment decision-making.

See how forest degradation affects your portfolio — Practical tools and lens-analysis for applying forest risk insights to your investment portfolio, with sector landscape analysis, materiality assessments, and corporate research data.

Understand common diligence pitfalls and confusing corporate disclosure — avoid common misconceptions that can lead to investment risk blind spots.

Join Us.

Be the first to hear about investor meetups, small-group discussions, and practical workshops focused on making forest degradation more visible.

Navigate to our Communications & Events tab to learn more about our upcoming events and stay connected with conversations, webinars, and the latest developments in forest risk assessment and investor engagement.